Challenges We All Know About

Does Your Financial Reporting Process Look Like This?

Stricter Regulations, Higher Scrutiny

Regulators like NFRA are tightening compliance requirements, increasing risk exposure for finance teams and boards.

Gaps In Financial Reporting Processes

Inconsistent financial statement closures lead to errors, governance risks, and compliance issues for board members.

Forecast vs. Actual Discrepancies

Mismatched numbers create friction with stakeholders, making it harder to drive strategic financial decisions.

Lack of Visibility Across Subsidiaries

Limited oversight and inconsistent reporting standards lead to accountability gaps and compliance risks.

Fragmented Data

Broken Chart of Accounts, unreconciled acquisitions, and missing granularity in reports make financial insights unreliable.

Budget vs. Actual Reconciliation Nightmare

Inconsistent data across entities makes budget tracking and financial planning an ongoing challenge.

Features

Explore AI-Powered Onboarding Features

-

1Board-Ready Financial Statements

Comprehensive Financial Statement Generation for Timely Board Meetings

-

2ICO (Inter-Company Reconciliation)

Automated Inter-Company Reconciliation and Journal Entries

-

3Dimensional Reporting

Multi-Level Financial Analysis for Better Decision-Making

-

4AI-Enabled Onboarding

Automate ERP Integrations & GL Mapping with AI

-

5MULTI-CURRENCY SUPPORT

Seamless Global Financial Reporting

-

6BUDGET VS ACTUALS

Comprehensive Variance Analysis for Strategic Planning

-

7ROLES AND ACCESS

Secure, Role-Based Access Control for Your Organization

-

8AUTO JOURNAL ENTRY

Automated, Accurate, and Audit-Ready Journal Processing

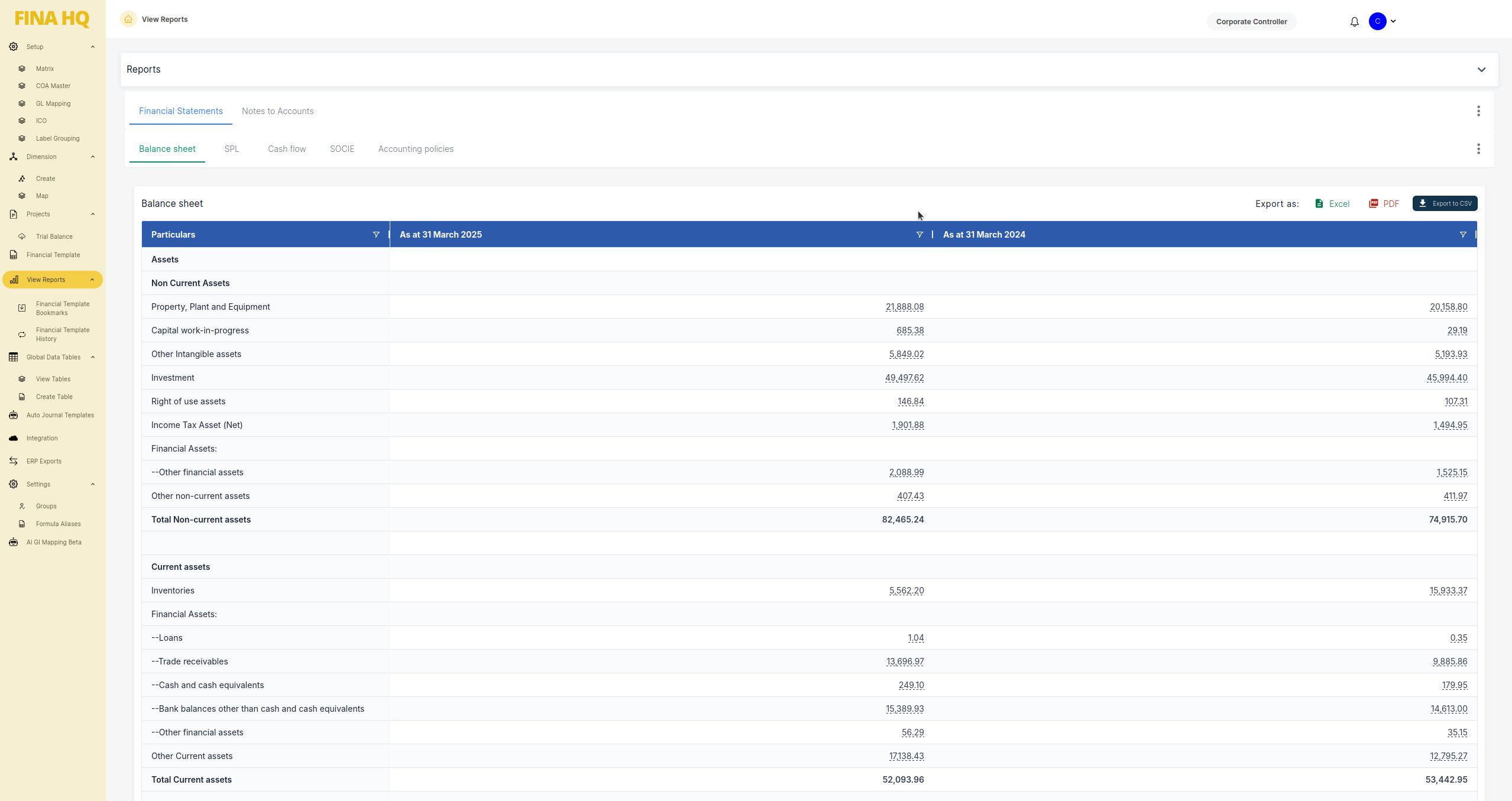

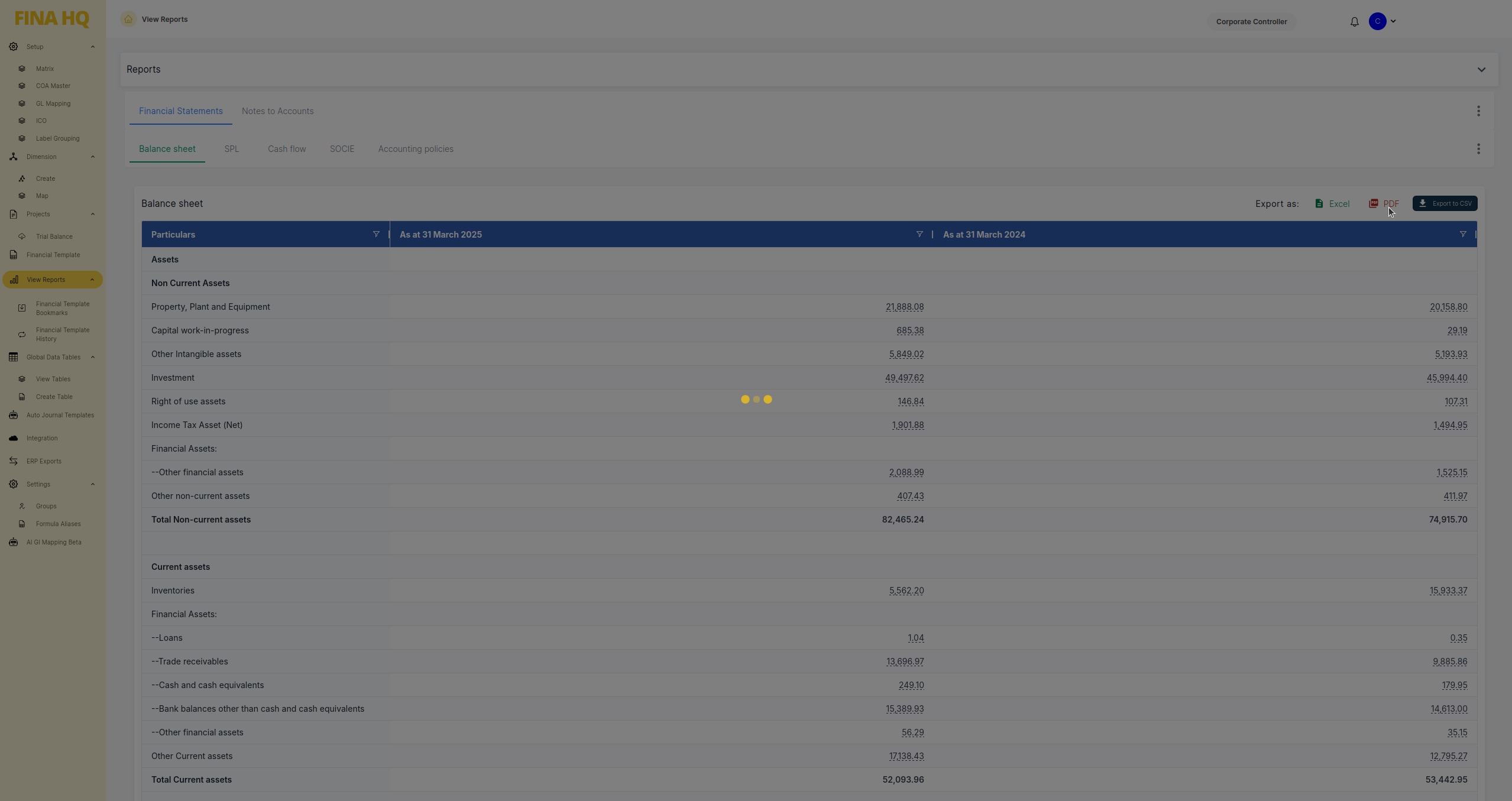

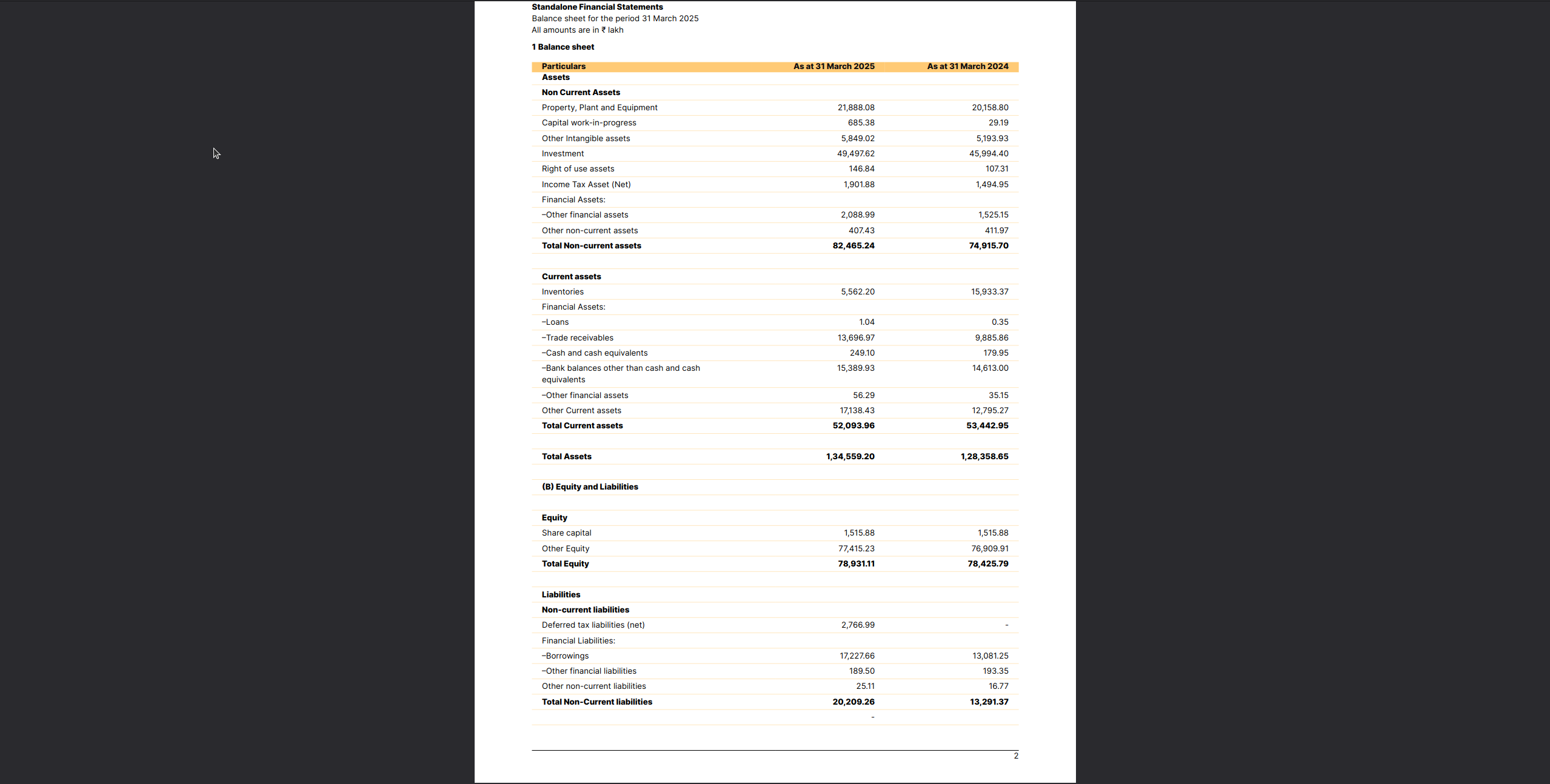

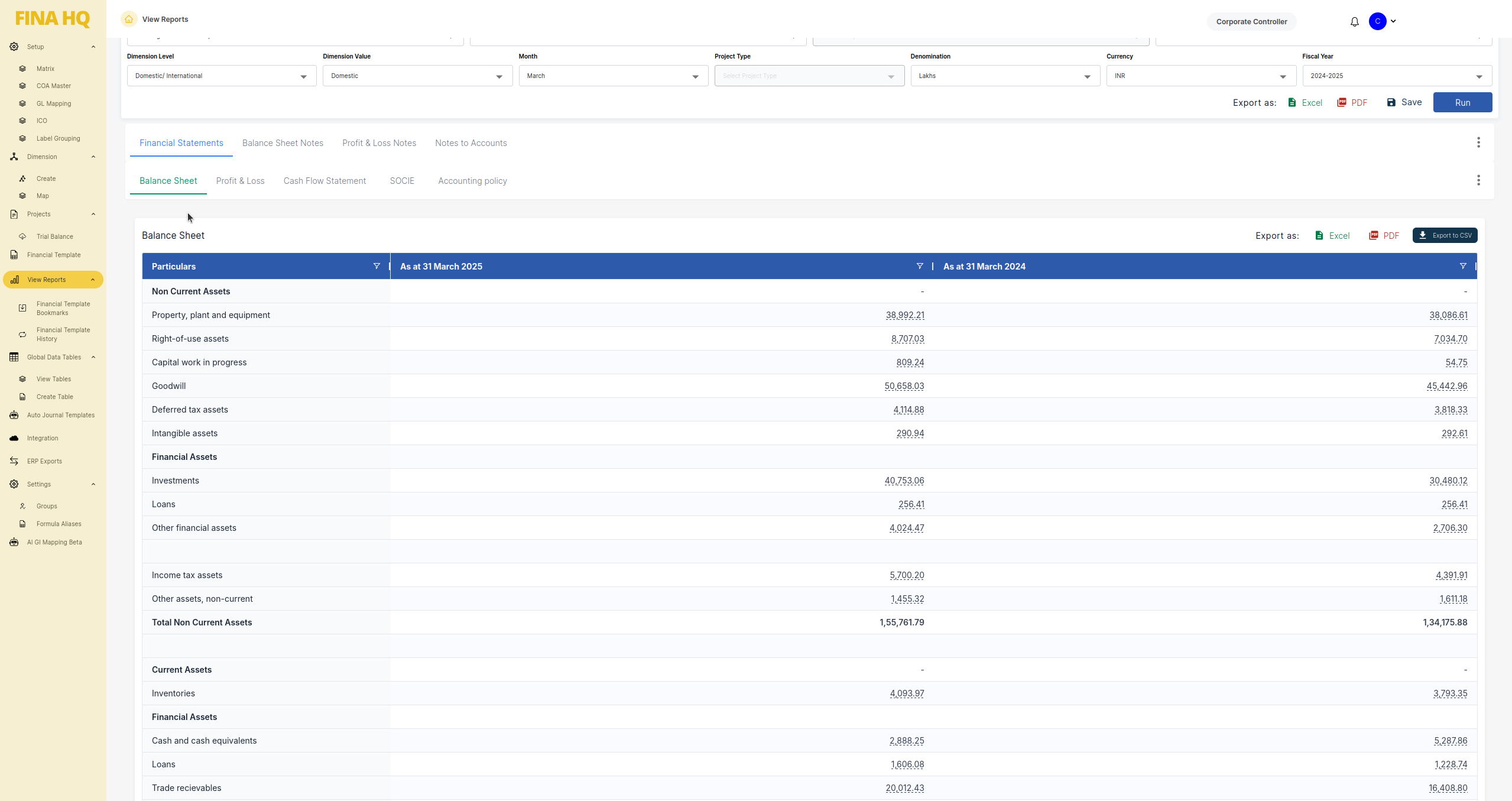

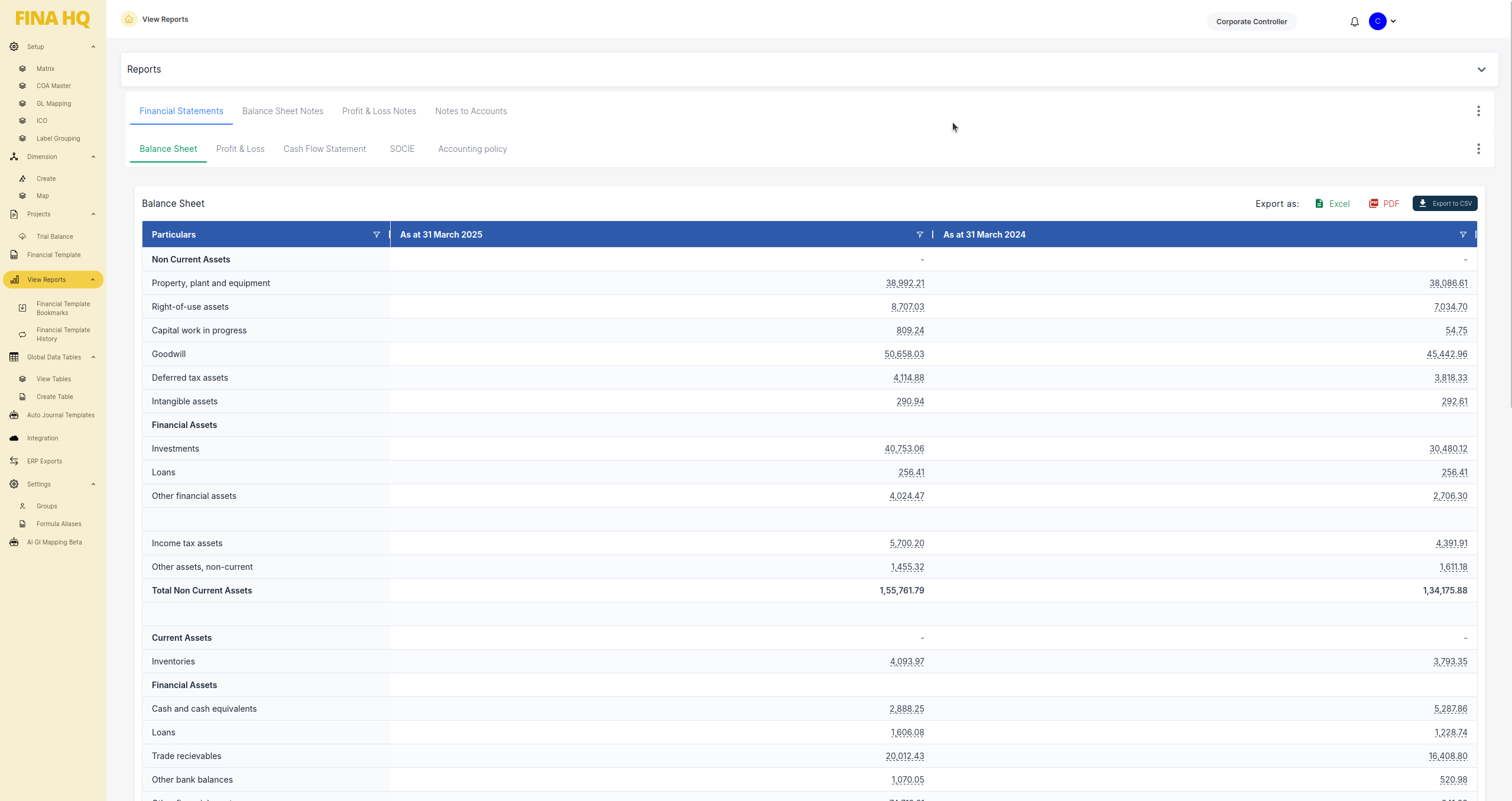

BOARD-READY FINANCIALS STATEMENTS

Comprehensive Financial Statement Generation for Timely Board Meetings

Need to prepare board-ready financial statements with complete accuracy and compliance? FINAHQ’s financial generation system ensures your statements are ready for board signature on the exact date of your board meeting, with automated template creation and real-time data compilation.

- Custom Template Builder – Create standalone or consolidated financial templates tailored to your group structure and reporting requirements.

- Automated Data Collection – Streamline disclosure and manual information gathering through intelligent forms, including MSME aging and fixed asset aging data tables.

- Statutory Compliance Integration – Seamlessly add required statutory information including auditor details and CIN numbers for complete regulatory compliance.

- Multi-Currency Generation – Generate comprehensive financial statements in any currency and denomination instantly with a single click, ensuring flexibility for global operations.

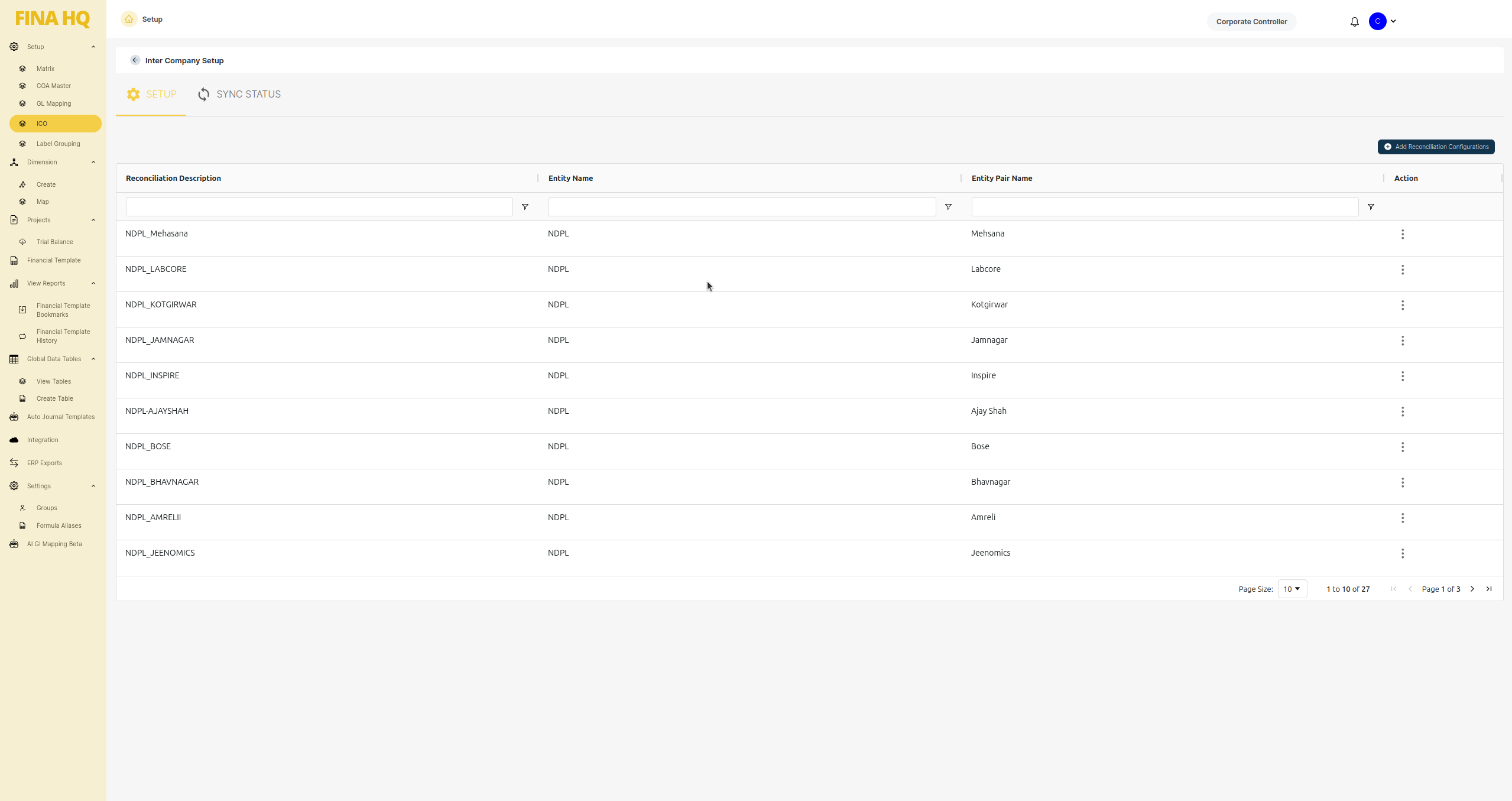

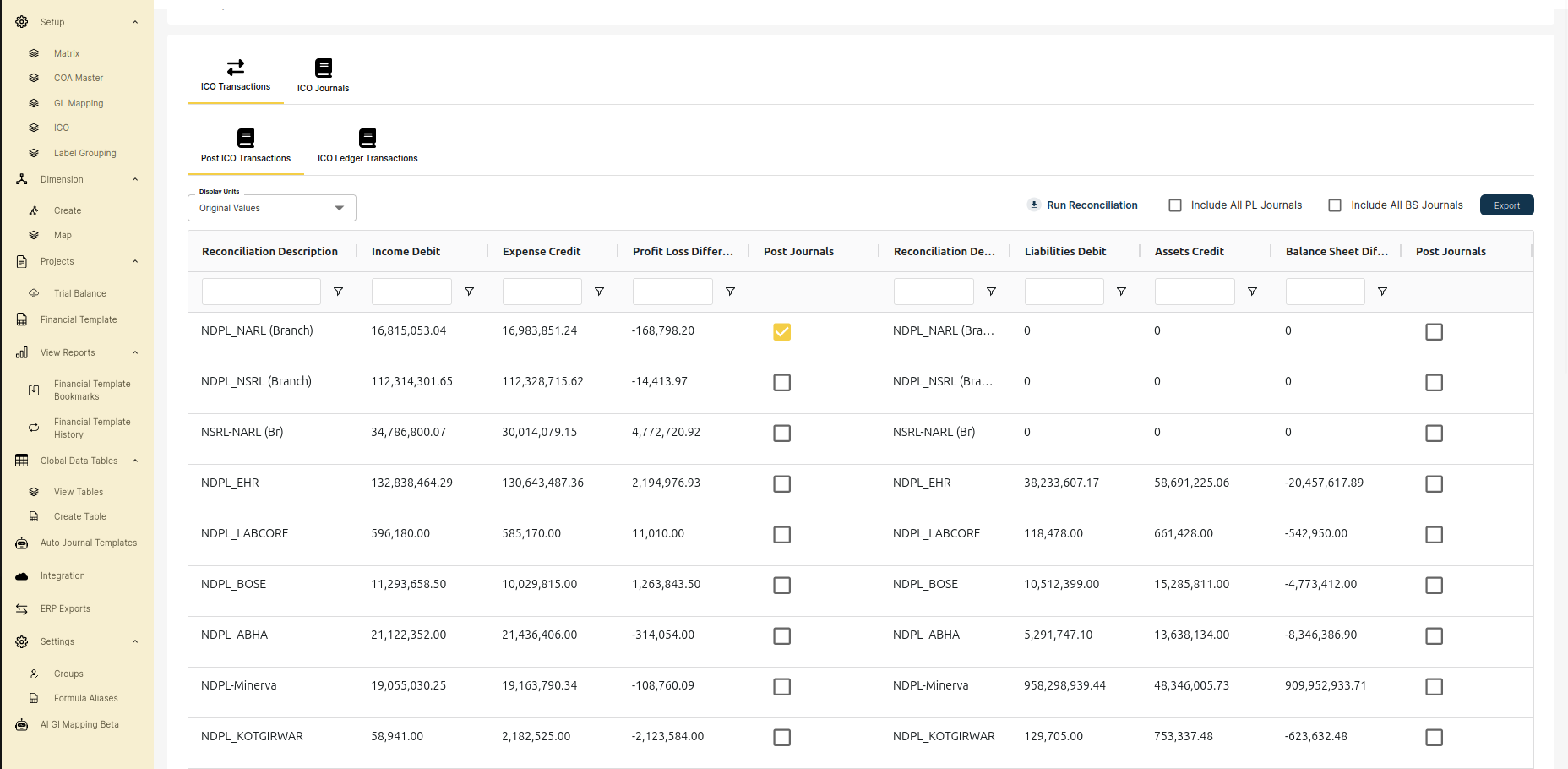

ICO (Inter-Company Reconciliation)

Automated Inter-Company Reconciliation and Journal Entries

Eliminate manual inter-company reconciliation with FINAHQ’s intelligent automation that works across multiple ERP systems and ensures accurate financial consolidation.

- Multi-ERP Integration – Automated ICO transaction reconciliation for SAP, Tally, QuickBooks, and more

- Smart Journal Entries – Auto-posting of ICO journal entries with complete audit trail

- Related Party Automation – Generate standalone related party disclosures automatically

- Flexible ICO Inclusion – ICO journals can be included or excluded from final financial statements as needed

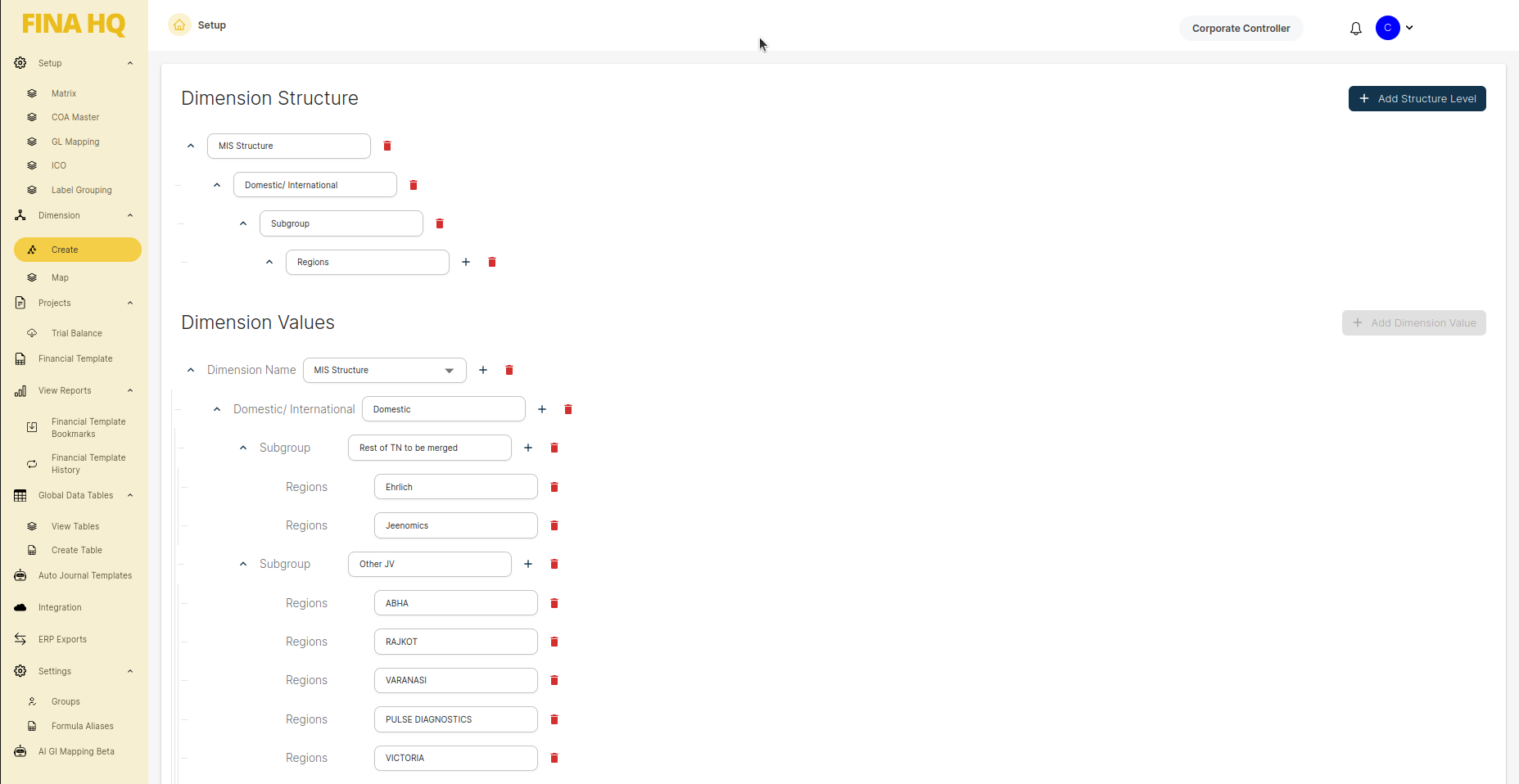

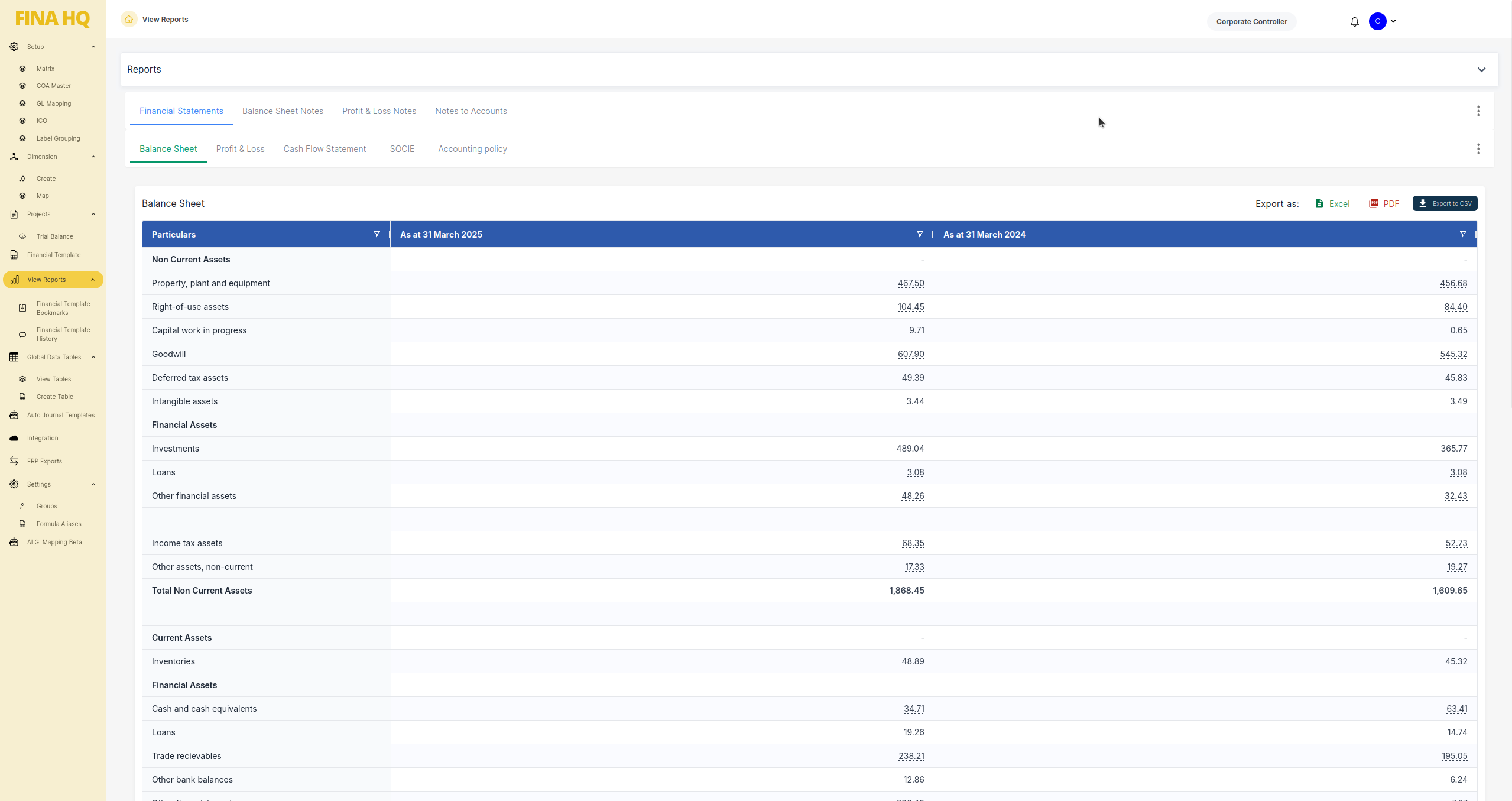

Dimensional Reporting

Multi-Level Financial Analysis for Better Decision-Making

Need to analyze performance by subsidiary, country, or business unit? FINAHQ’s dimensional reporting makes it simple, with real-time data slicing and aggregation.

- Customizable Financial Dimensions – Adaptable to your reporting needs.

- Drill-Down Capability – View consolidated reports or zoom in on specific entities.

- IFRS & SEBI Compliance – Generates structured, audit-ready financial statements effortlessly.

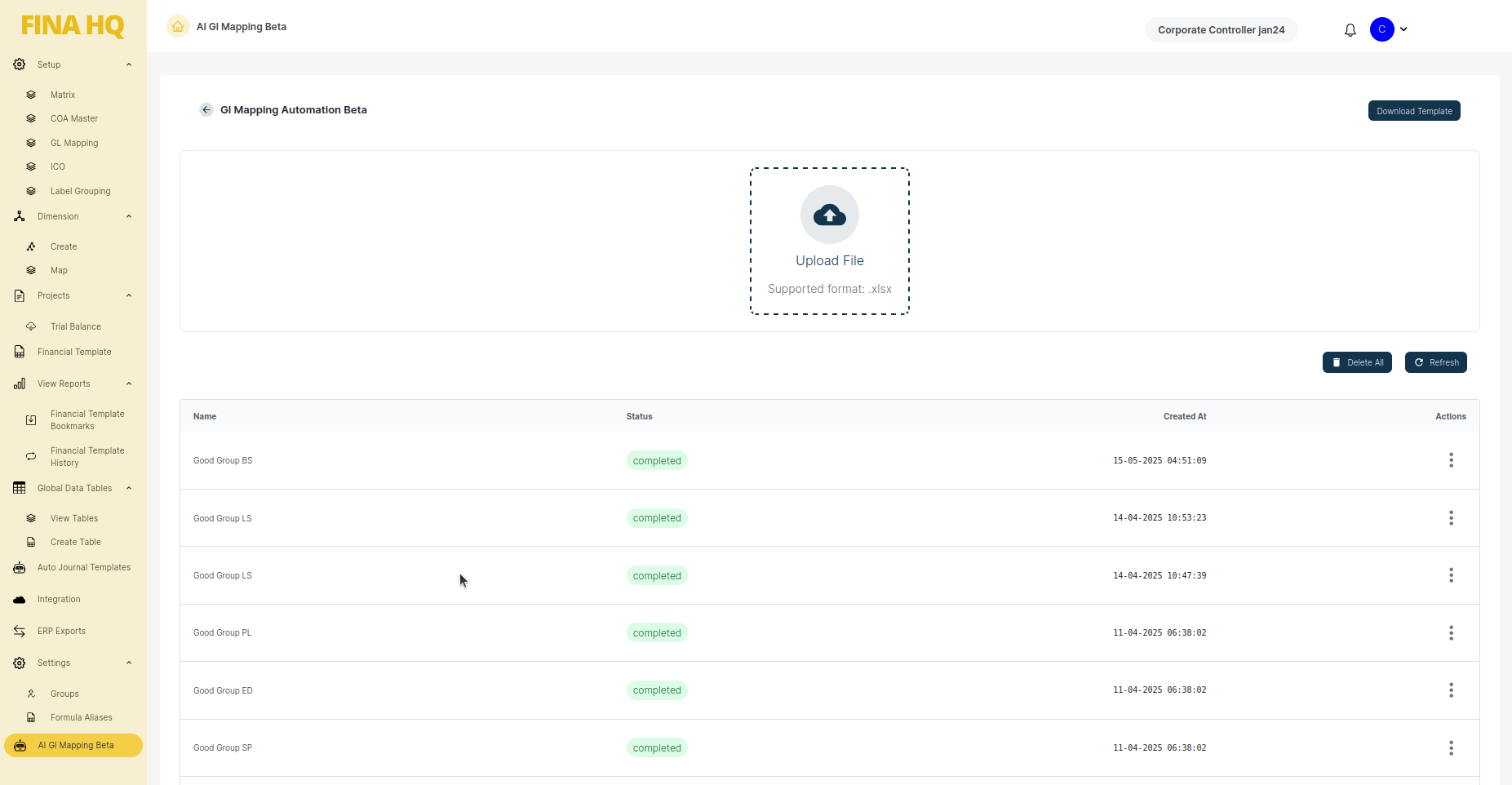

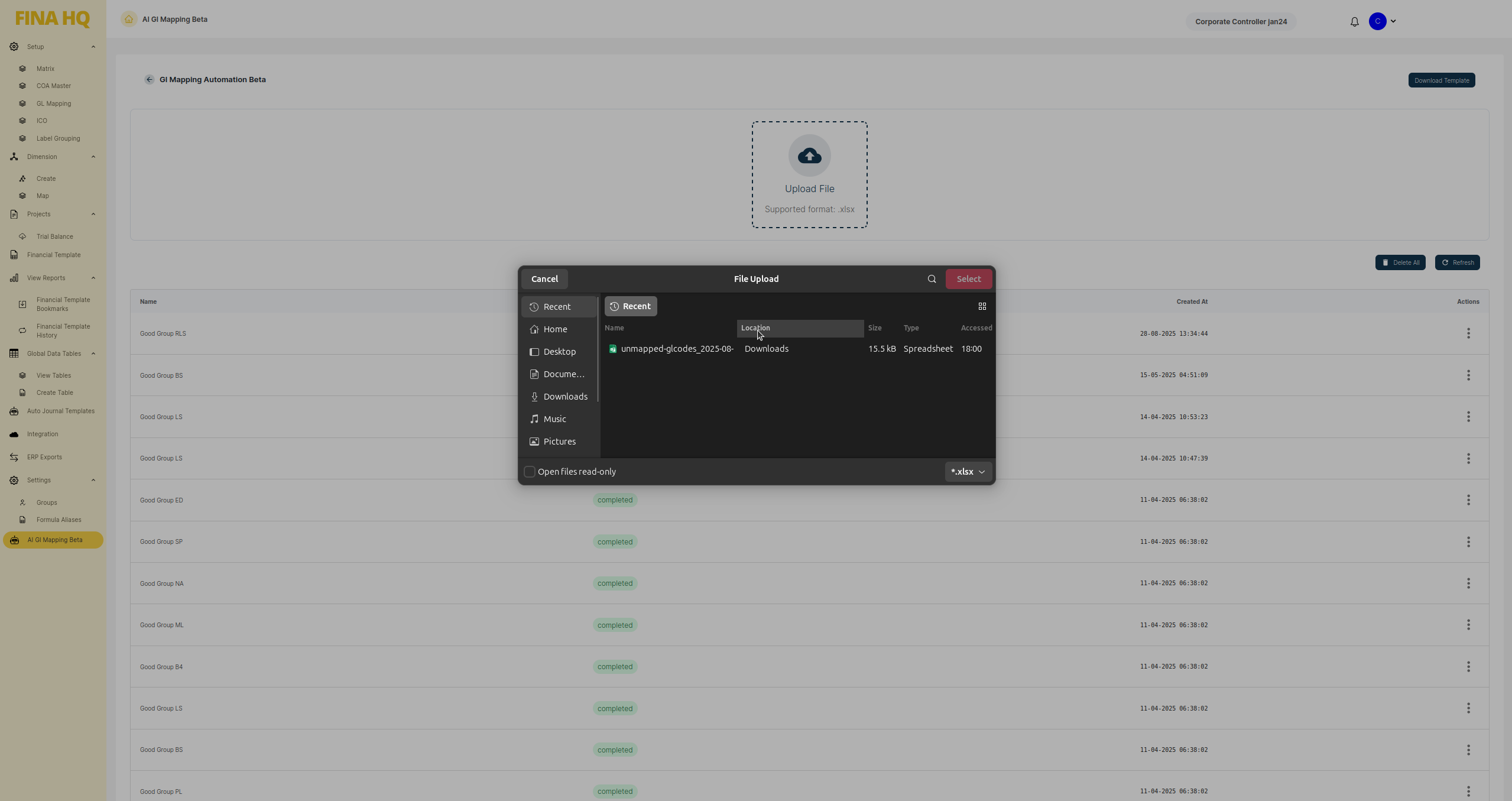

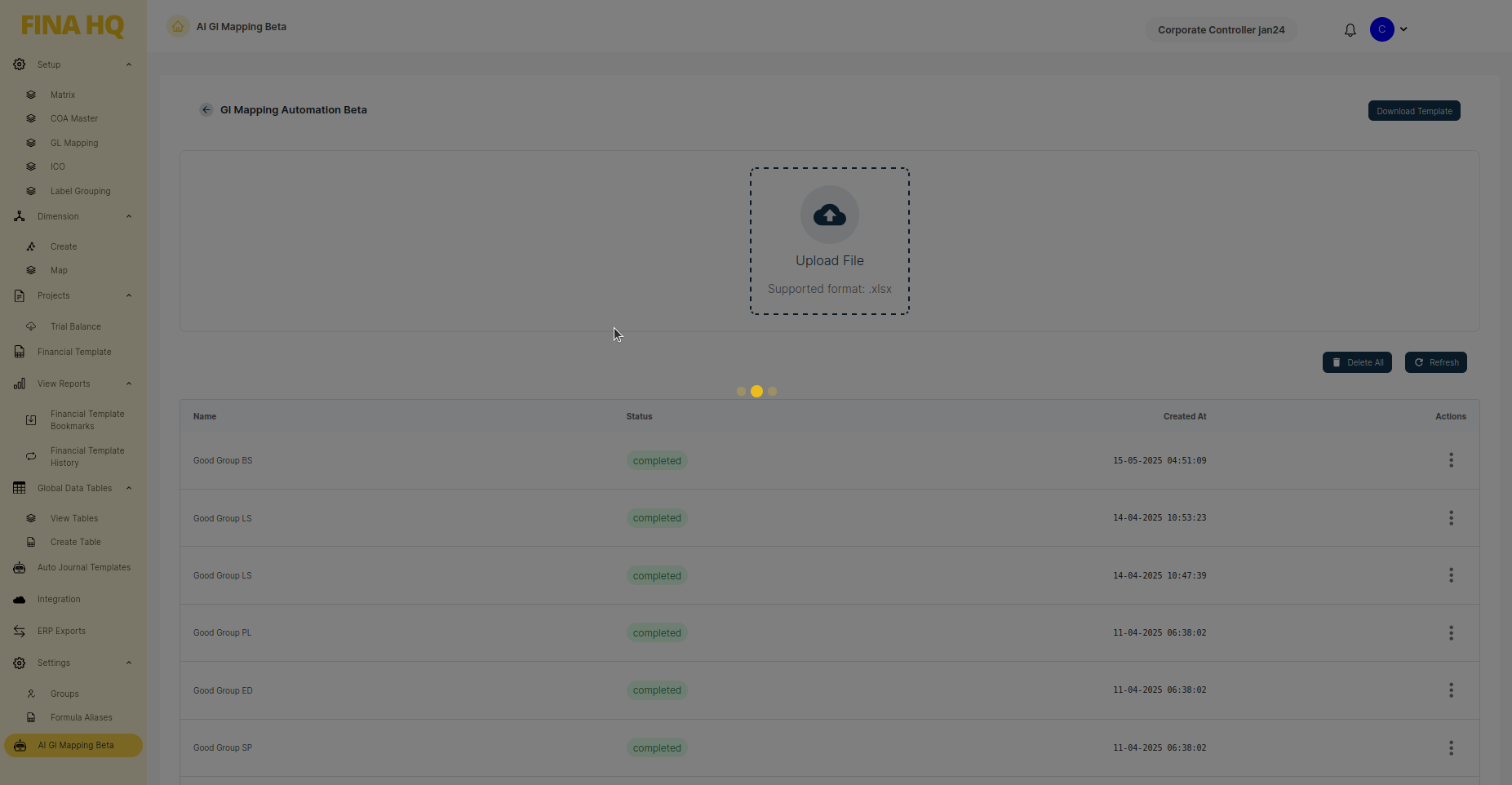

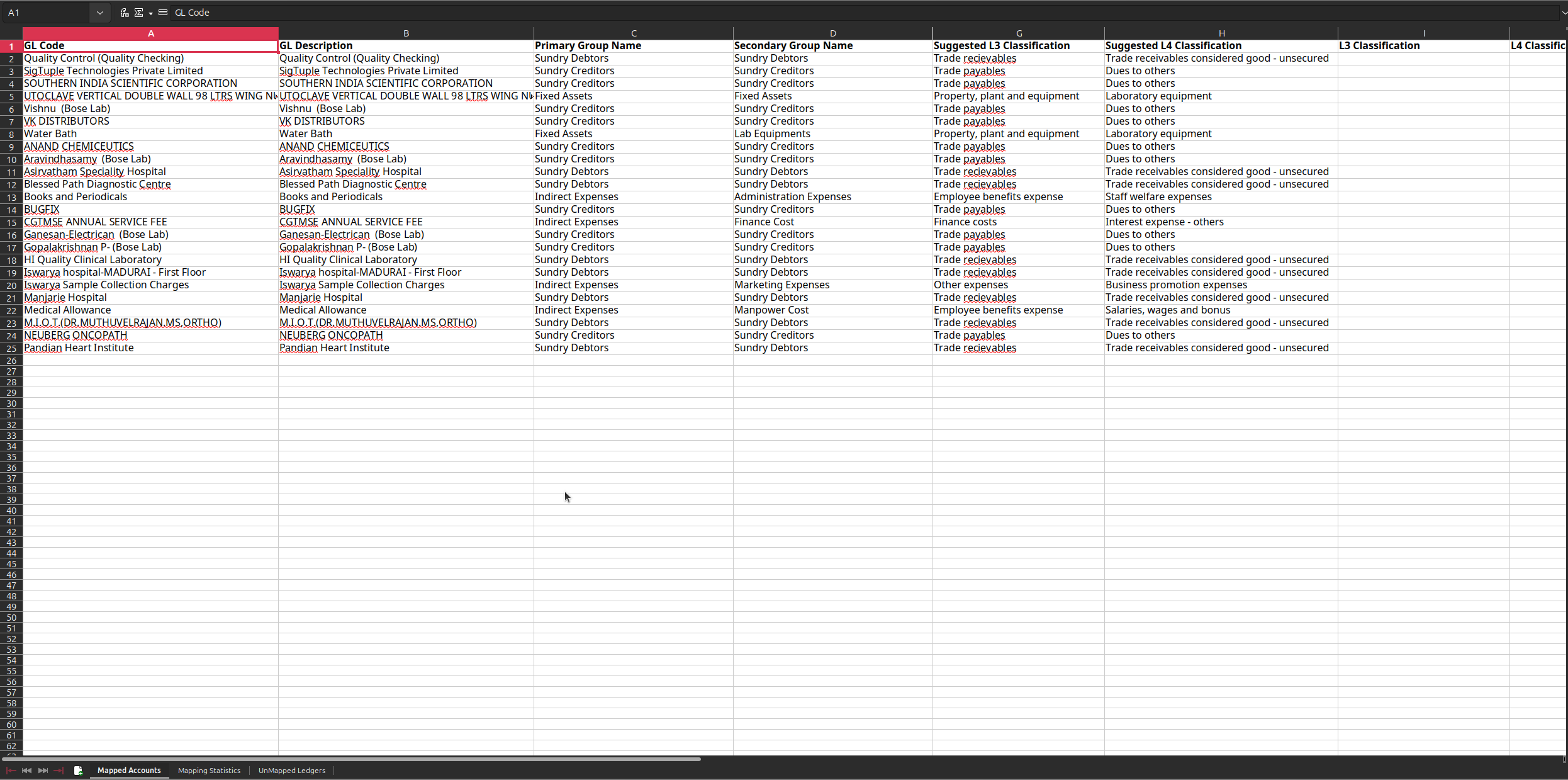

AI-Enabled Onboarding

Automate ERP Integrations & GL Mapping with AI

Visualize onboarding efficiency with pre-built templates and automated workflows that streamline the process from start to finish.

- Seamless ERP Integration – Supports Tally, SAP, QuickBooks, Xero, and Microsoft Dynamics.

- AI-Powered GL Mapping – Instantly maps thousands of GL codes with minimal human intervention.

- Minimal Effort from Your Team – 90% of the onboarding is handled by FINAHQ, allowing your team to focus on core tasks.

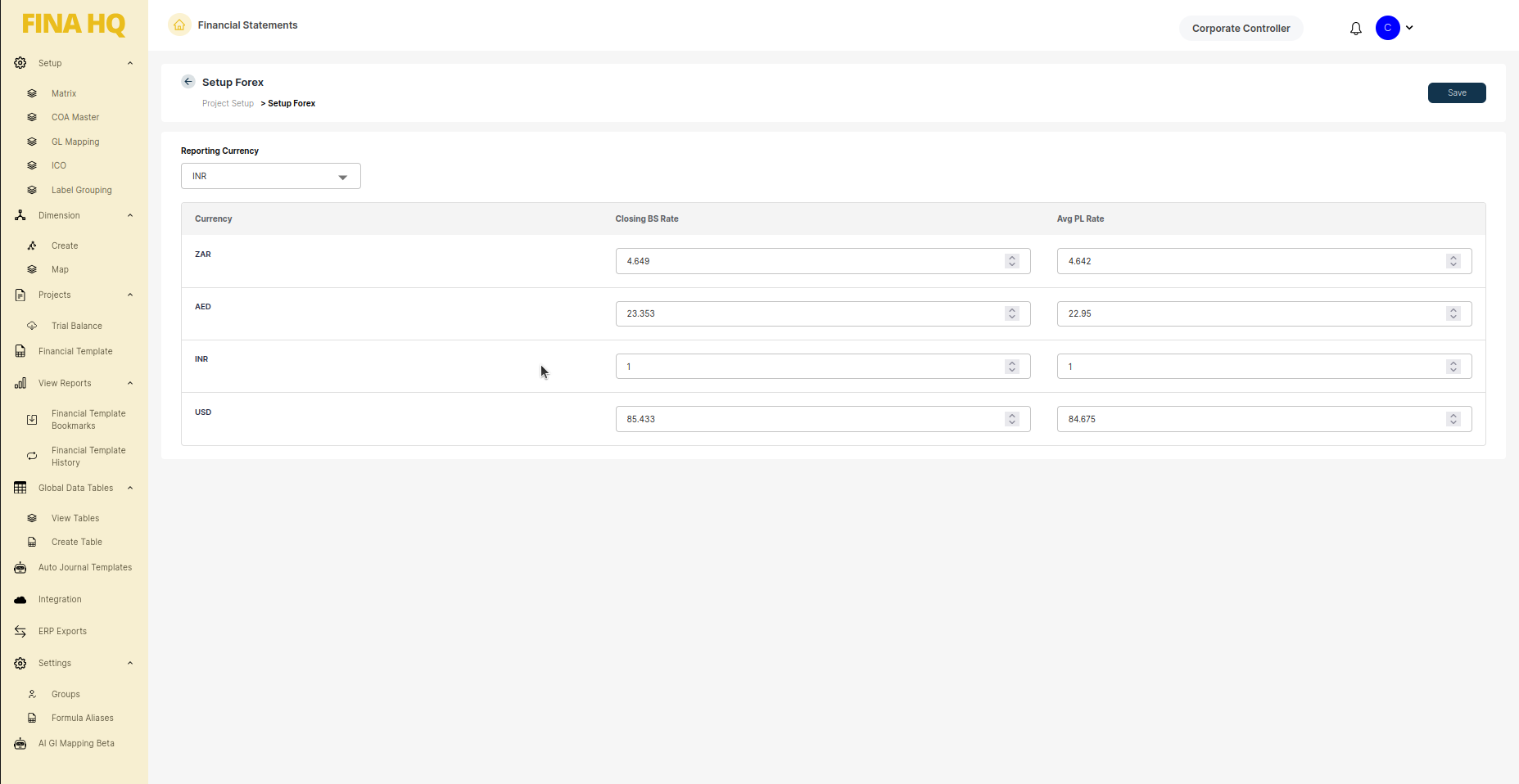

MULTI-CURRENCY SUPPORT

Seamless Global Financial Reporting

Need to generate financial statements in multiple currencies for your international operations? FINAHQ’s multi-currency system automatically handles exchange rates and currency conversions, ensuring accurate financial reporting across all your global entities.

- Automatic Rate Selection – System intelligently picks the most appropriate exchange rates for each currency pair and transaction type.

- Flexible Currency Selection – Choose your preferred reporting currency before generating financial statements, with seamless conversion capabilities.

- Real-Time Multi-Currency Reports – Tool automatically computes accurate forex rates for both closing balances and average balances across all currencies.

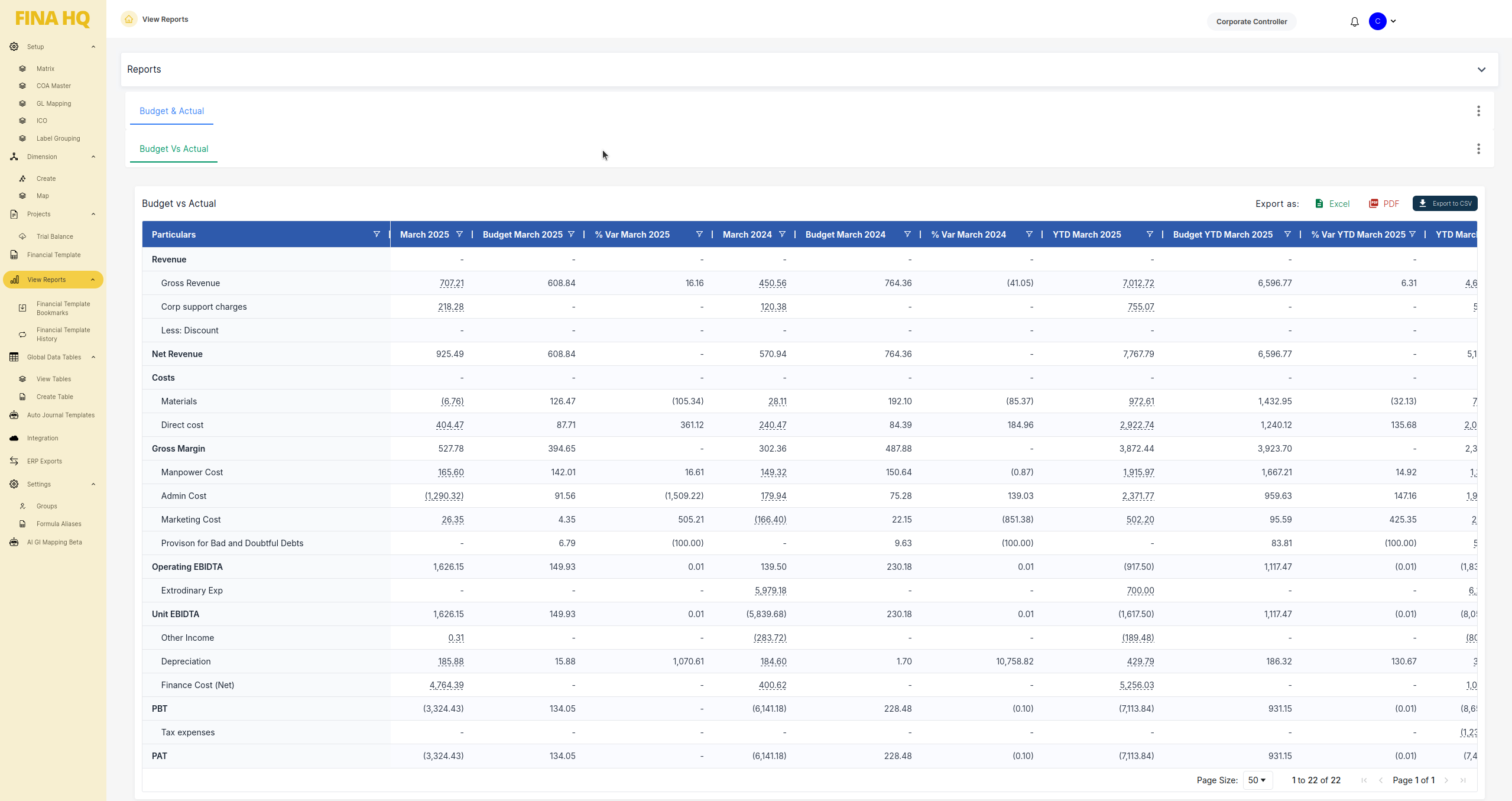

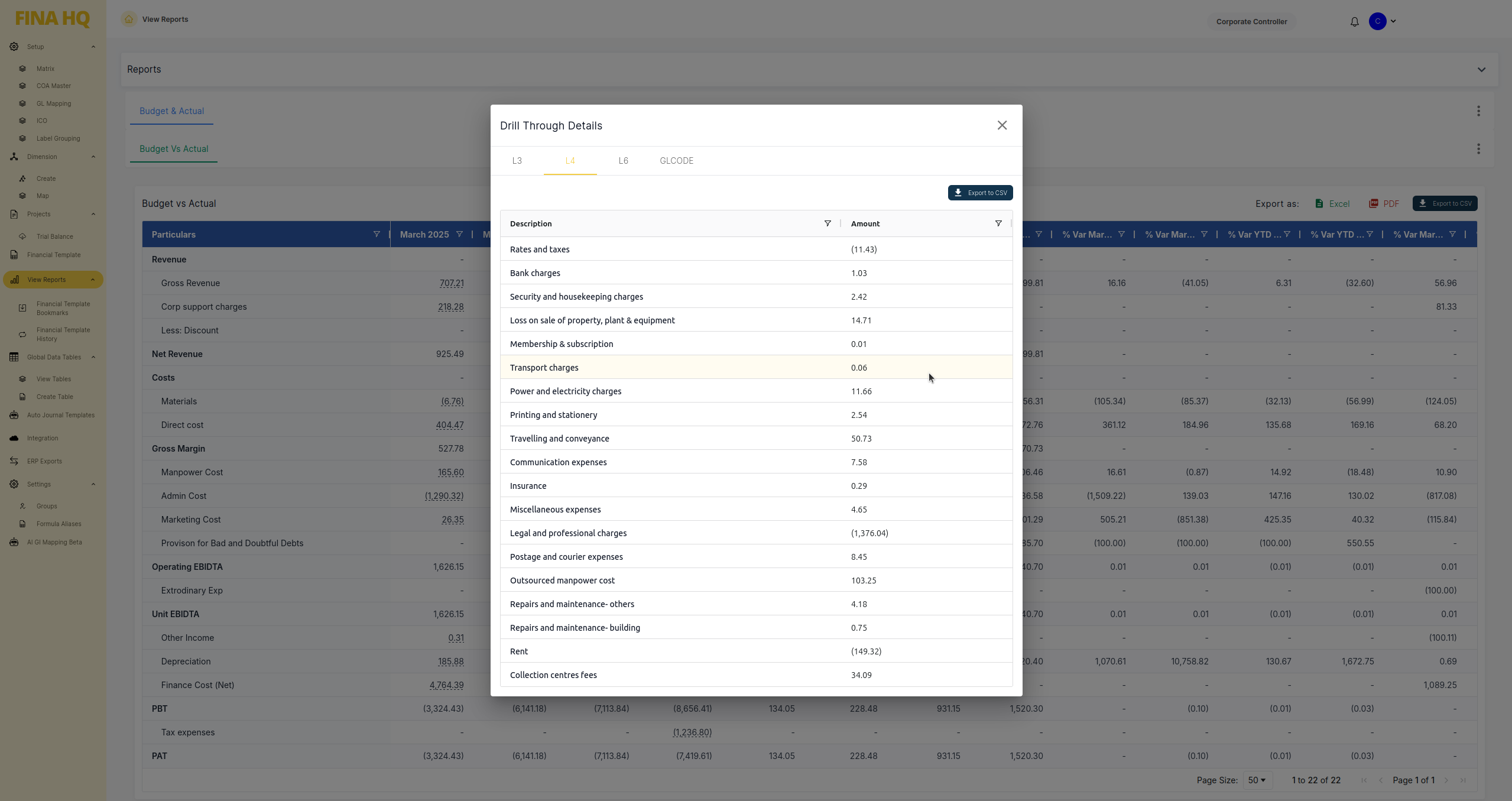

BUDGET VS ACTUALS

Comprehensive Variance Analysis for Strategic Planning

Need to track performance against budgets across multiple dimensions? FINAHQ’s budget vs actuals system provides detailed variance analysis with drill-through capabilities, helping you identify trends and make informed strategic decisions.

- Multi-Level Comparison – Compare budget vs actual at entity level or dimension level (state, business segment, etc.) for comprehensive performance tracking.

- Drill-Through Analysis – Drill through actuals to understand detailed breakups and identify root causes of variances with complete transparency.

- Custom Group Mapping – Create custom groups and sub-groups that align with both MIS Chart of Accounts and Statutory COA for flexible reporting.

- Personalized Views – Build personalized custom views for different users, ensuring each stakeholder gets relevant insights tailored to their role.

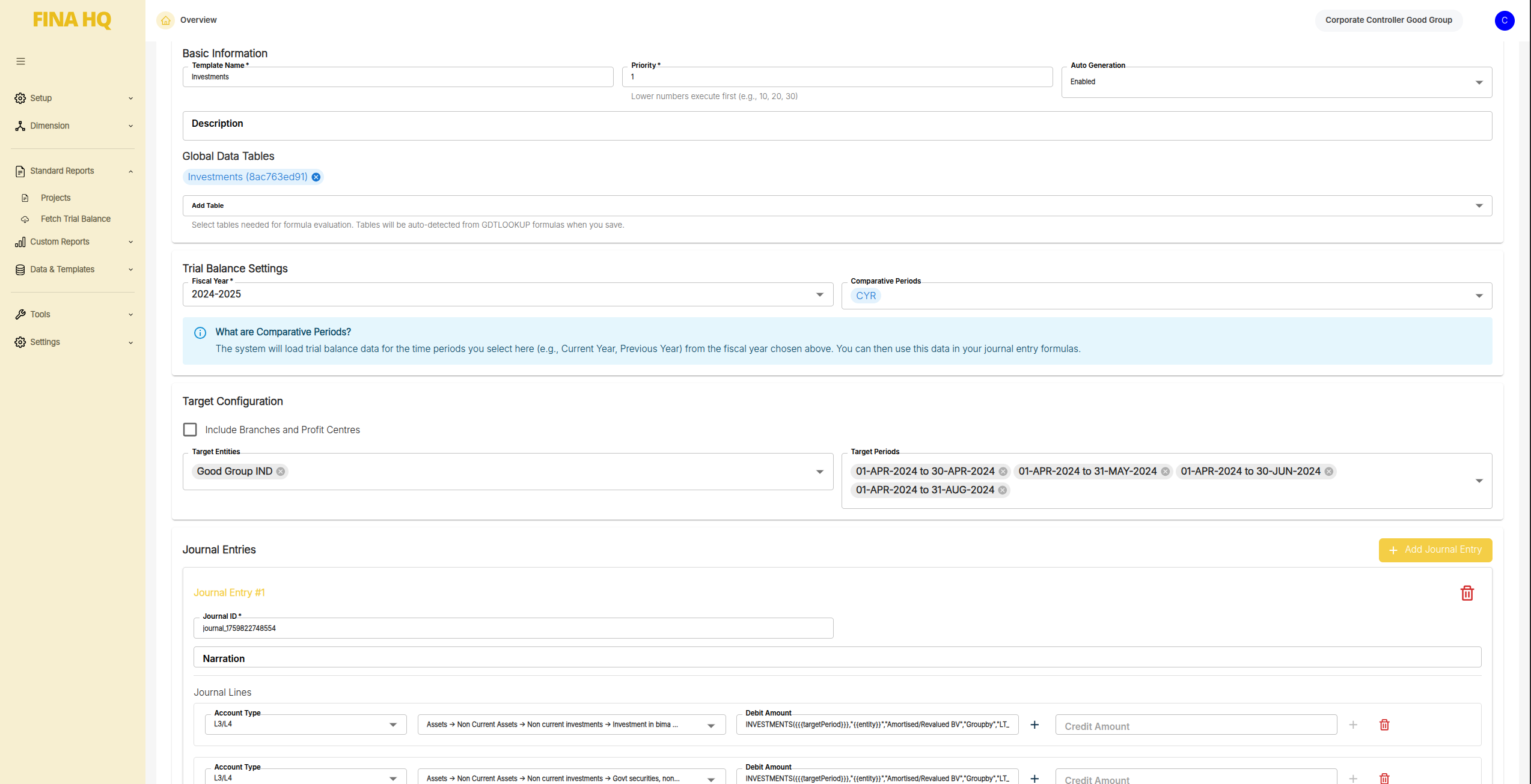

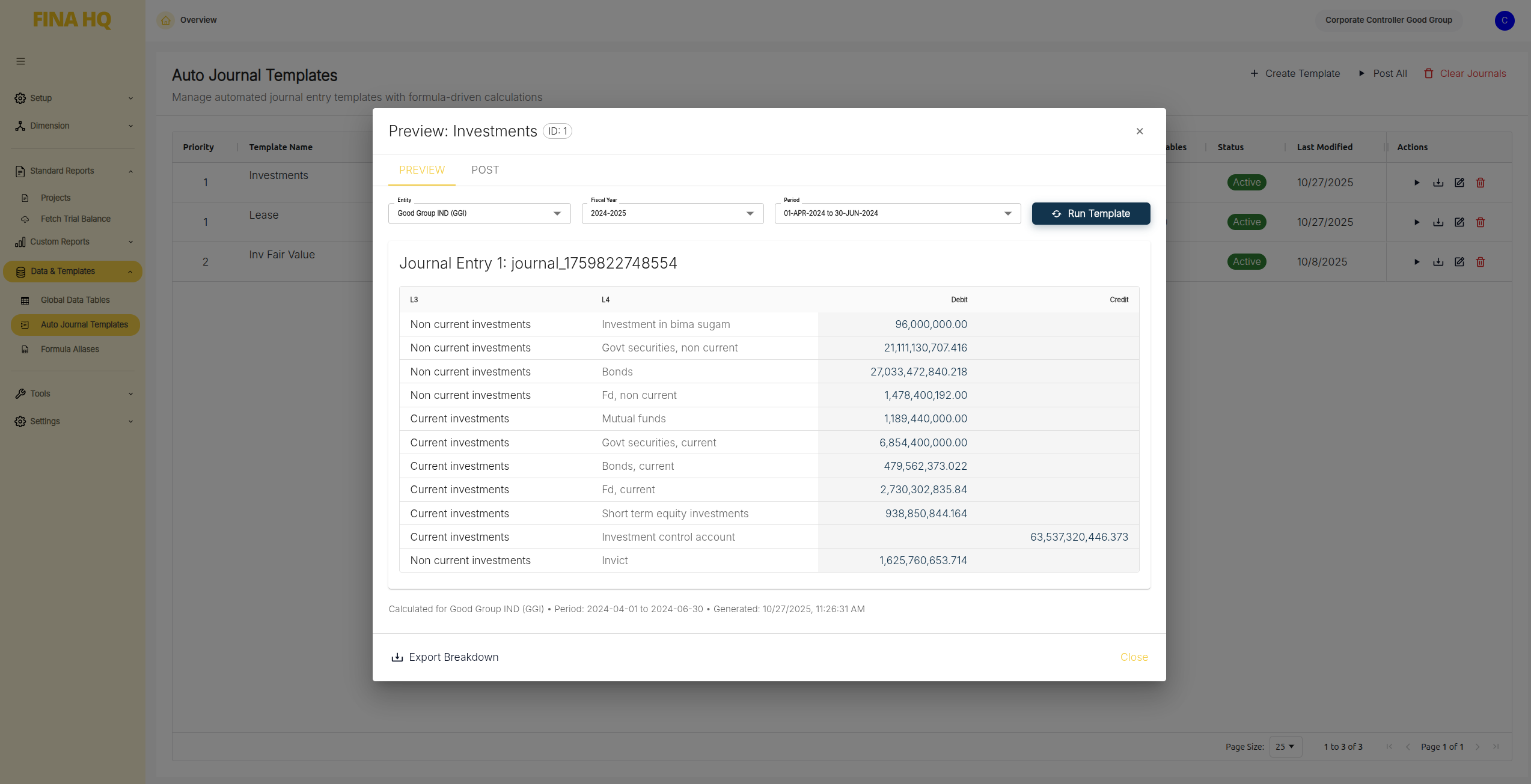

AUTO JOURNAL ENTRY

Automated, Accurate, and Audit-Ready Journal Processing

Need to streamline recurring accounting adjustments and eliminate manual errors? FINAHQ’s Auto Journal Entry module automates complex journal postings, ensuring accuracy, compliance, and consistency across your financial close process.

- Cost Allocation – Cost allocation based on predefined drivers such as Revenue, Headcount, or asset utilization.

- Lease Accounting – Lease accounting entries for right-of-use assets, liabilities, and periodic interest or depreciation recognition.

- Fair Value Adjustments – Fair value adjustments and unrealized gain/loss recognition for investment accounting.

- Flexible Configurations – Flexible configuration layer for defining logic, drivers and allocation keys without coding and dynamic parameterization enabling periodic scheduling or event-triggered posting.

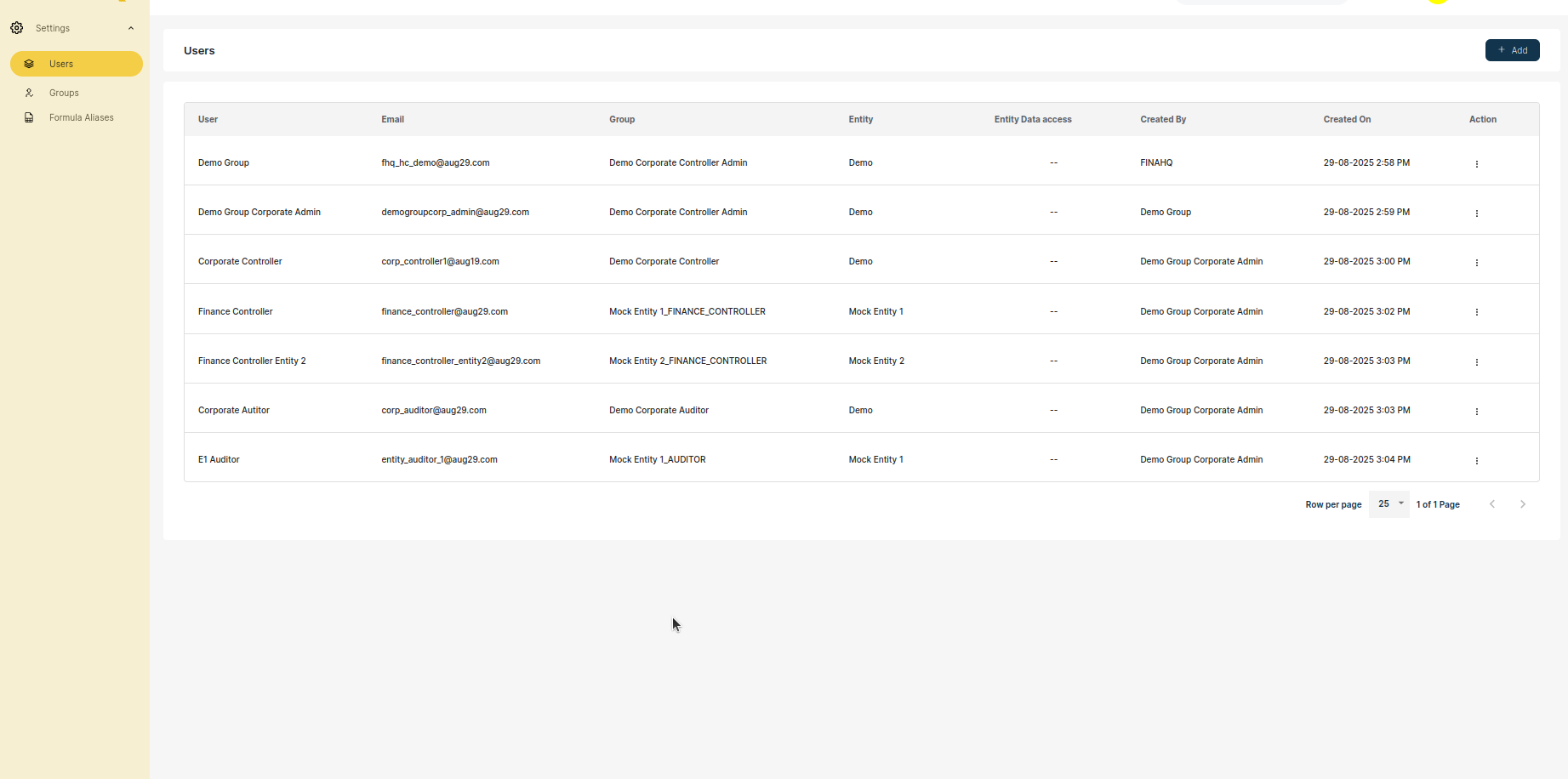

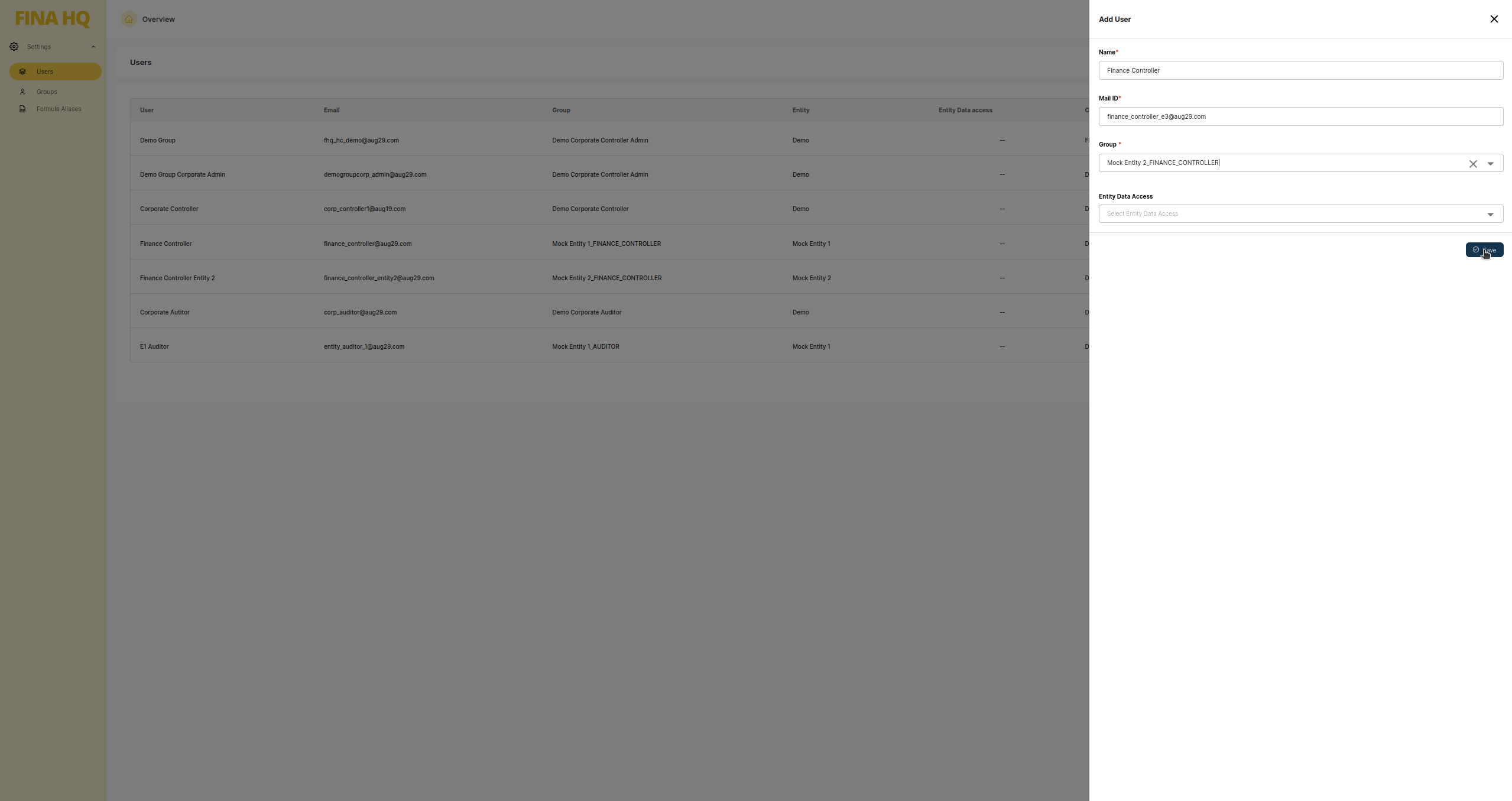

ROLES AND ACCESS

Secure, Role-Based Access Control for Your Organization

Need to ensure the right people have the right access to your financial data? FINAHQ’s role-based system provides secure, controlled access across your entire organization, from corporate leadership to individual entities and external auditors.

- Corporate Administrator – Full control to create and manage user accounts across your entire group, ensuring proper access management and security.

- Corporate Controller – Complete access to all group data and operations, enabling comprehensive oversight and strategic decision-making.

- Finance Controller – Access limited to specific entities they manage, providing focused control while maintaining data security and compliance.

- Auditor Access – Dedicated auditor accounts for seamless verification processes, allowing external auditors to review financial data without compromising internal access controls.

Testimonials

Trusted by Leading Financial Teams

Neuberg Diagnostics Private Limited

"FINAHQ is an extremely impressive application that has helped us drive efficiency in our financial reporting process. FINAHQ is partnering with Neuberg on our journey to meet best-in-class financial reporting standards. I have been particularly impressed with the amount of time and effort Arjun has put into making the onboarding experience seamless for us to coordinate with multiple stakeholders. I would recommend this application to groups who are looking to simplify their financial reporting processes."

- Vivek Srinivasan, Group CFO

Veranda Learning Solutions Ltd

"We tried several solutions prior to FINAHQ and we were quite pessimistic before the POC considering our complexity. We were blown away by how well FINAHQ worked and the team was able to demonstrate a complete POC which reconciled financials to our last audit. FINAHQ saves my team easily more than a week on monthly close and I believe we can still get more efficient over time."

- Mrutyunjaya, Group Controller

Madurai Power Corp Pvt Ltd

"I am impressed with how well FINAHQ works with Tally. As promised with FINAHQ we have transitioned with 18 months of prior information and today MIS reports / Financials are accessible for me and my team at the click of a button. FINAHQ's Tally connectors are impressive in how they bridge the gaps and understand nuances of Tally and provides real-time reporting in an accessible manner to me and my team."

- Balakrishnan, MD

Swelect Energy Systems Limited

"The implementation of FINAHQ has transformed our financial reporting process. What previously took weeks of effort from our entire finance team can now be accomplished in days with significantly fewer resources. Having signature-ready financial documents available on the day of our board meetings has been a game-changer for our approval process."

- Nikhila Group CFO, Swelect Energy Systems

Sri Ramakrishna Hospital & Colleges

Reduction in Manual Reporting Workload

Compliance with SEBI & IFRS

Seamless integration across all ERP systems

Don’t Let Manual Reporting Slow You Down Any Longer

Discover how FinaHQ transforms financial reporting and compliance. Join top companies experiencing faster, error-free, and stress-free financial control.